Are You Prepared for the Change to Accounting for WIP on Your Taxable Income?

Historically, paragraph 34 (a) of the Income Tax Act (the “Act”) allowed designated professionals like lawyers, dentists, medical doctors, veterinarians and qualified accountant to file an election to exclude the value of their year-end work-in-progress (“WIP”) for projects where the work was completed over a period of time from taxable income for the current year. This approach was commonly referred to as billed-basis accounting (“BBA”) because the income was recognized into taxable income when the client was billed.

On March 22, 2017, the federal government proposed to revoke the election effective for all fiscal years that begin after March 22, 2017. Upon passing of the legislation, going forward, the WIP is deemed to be inventory as required by paragraph 10 (5) (a) of the Act.

In this article, we will discuss the impact of this change on accounting and costing of WIP on law firms, transitional rules, and, finally, I will give some practical business implications on law practices.

Impact of changes on accounting and costing of WIP

In the past, law firms were not required to present their WIP in the computation of their business income, so the calculation of WIP for tax purposes was not a priority. But with the change in the legislation, the determination and calculation of WIP will be required in the computation of taxable business income. To make the situation even more interesting, there is no legislative definition of WIP in the Act. This lack of guidance means judgement is required in accounting and costing of WIP. I expect this will result in diversity in practice amongst practices.

Nevertheless, in order to determine the appropriate approach for this evolving area, the goal should always be an accurate presentation of the tax filer’s profit[1] for the fiscal year.

Currently, inventory is valued at lower of cost or fair market value (“FMV”) (“LCM”). Thus, this would be an acceptable approach for WIP accounting and costing for law firms. However, there is an option to record WIP at FMV or in a prescribed manner but depending on the situation it may result in higher business income.

Let’s look at what fair market value and costing of WIP entails:

Similar to other professional services firms, law firms typically carry their WIP based on billing or charge-out rates of lawyers on the file and it’s reasonable to assume this is the expected amount to be billed. Accordingly, from an accounting stand-point, it is the carrying value of the WIP approximate fair market value (inclusive of an implicit profit margin).

There are two options to determine the WIP cost: 1) direct costing or 2) full absorption. These are discussed in CRA’s past administrative guidance[2] as reasonably acceptable approaches in the calculation of inventory and now, by analogy, as applicable for WIP as well.

Under the direct costing method, firms are required to allocate variable overheads to WIP. That will mainly include professional costs in case of law firms. However, it’s important to note that there is no clear guidance in the Act or in CRA’s administrative position or even in accounting guidance (both under International Financial Reporting Standard or Accounting Standards for Private Enterprises) for professional services providers, like law firms. Accordingly, the law firms must exercise judgement. While under the absorption costing method, the firm will allocate variable and fixed overheads in the determination of the WIP. Under this method, in addition to variable cost, the firm is required to allocate general overhead expenses.

For matters/files with contingent consideration, there is an expectation to establish an amount that is reasonably expected to be received from such an arrangement. That means, until the contingence is solved and the right to collection of an amount is established, it may be acceptable for no amount to be recognized within the firm’s taxable income.

Lastly, this latitude to exercise judgement in valuing WIP requires a method that “correctly” and “accurately” presents the firm’s income for the year. Accordingly, I would expect each law firm to make a determination taking into account consideration its situation, type of service provided, and related transaction flow.

[1] Supreme Court of Canada’s decision in Canderel v. the Queen ([1998] 1 SCR 147)

[2] Interpretation Bulletin IT-473R (paragraph 12).

Transitional Rules

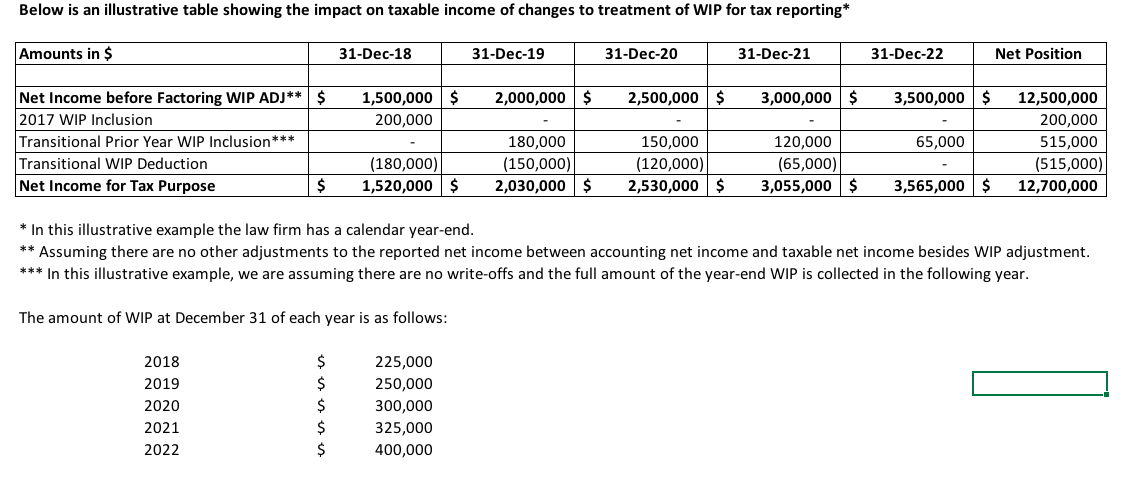

This is a radical change in accounting and costing WIP during the calculation of taxable income for law firms. To alleviate the impact of this change, the change allows a five-year phase-in period for taxation years beginning the effective change date of March 22, 2017. For calendar year law firms, the first tax year affected is the year ending on December 31, 2018. Depending on the level of unbilled activities, law firms may face unexpected tax liability (i.e. stain on cash flow) on unbilled WIP. However, the new rules provide for a five-year transition period that allows including 20% of WIP (depending on the approach discussed above) in the first year, 40% in the second year and by fifth year, include 100% of the WIP.

Transition Issues

Many law firms have traditionally used the exemption to exclude WIP in the calculation of their taxable income. So, this change will require updating the current system, accounting and costing processes of tracking and reporting WIP. A determination is required of various costs elements within WIP to ensure there is proper supporting documentation for the law firm’s position on the yearly tax filing. In addition, law firms should revisit their internal processes to potentially accelerate the billing and collection (where possible) to better manage the cash flow impact of tax liability. Finally, law firms should assess whether these changes require revisions or amendments (with relation to draws, retirements, taxation income allocation, etc.) to the partnership agreement.

Mayur Gadhia, CPA, CA, is the Founder of CloudAct CPA Professional Corporation, a Toronto based firm providing taxation, accounting and business advisory services to lawyers and law firms. He can be reached at 416-985-4978 or mayur@cloudact.ca.

This article is a generic overview. Talk to a qualified tax professional to discuss the tax implication based on your specific circumstances. Tax laws are complex and are subject to frequent changes. Professional advice should be sought before implementing any tax planning. CloudAct CPA Professional Corporation cannot accept any liability for the tax consequences that may result from acting based on the information contained therein.